Akhuwat Loan Apply Online – Akhuawt Loan Online Apply

Welcome to Akhuwat Loan Apply Online – Akhuawt Loan Online Apply

Welcome to Akhuwat Loan Appl Onliney, your gateway to financial empowerment and prosperity. In today’s dynamic and ever-evolving economic landscape, attaining financial freedom transcends being merely a goal; it represents a journey toward a brighter, more secure future. At Akhuwat Loan Apply Online , Akhuwat Loan Apply Online we understand the importance of financial independence and are dedicated to providing you with the tools, resources, and support you need to unlock your true potential and realize your dreams.

- akhuwat foundation We have recently become aware of individuals impersonating Akhuwat Foundation representatives and soliciting money from the public. Before engaging with anyone claiming to represent Akhuwat Foundation, verify their credentials with us akhuwat. Remember, only Akhuwat Foundation grants loans, and any suspicious activities should be reported immediately akhuwat loan. Stay vigilant and contact us directly for any concerns or verification akhuwat loan scheme 2023 online apply. Thank you for your cooperation.

The Essence of Financial Freedom

Financial freedom is the cornerstone of a fulfilling and rewarding life. It’s about having the ability to make choices that align with your goals, values, and aspirations without being hindered by financial constraints akhuwat loan apply online. In this chapter, we delve deep into the essence of financial freedom, exploring what it means to be financially independent and how you can achieve this state of empowerment with the help of Akhuwat Loan Apply.

Check Your Loan Status Online Here

Dear Customers Now you can Akhuwat Loan Apply Online here. To Check Your Loan status online Please Enter your Valid CNIC Number and Official File Number Provided by the Akhuwat Loan Department. If you have any Problem with Checking Loan Akhuwat Loan Online Apply please Call at Akhuwat Loan WhatsApp Helpline Number Thanks!

How you can Check Akhuwat Loan Status Online?

akhuwat loan application form pdf When you take a loan from Akhuwat, it should also have a mechanism to check you so that you know how many installments you have paid and how much is left akhuwat loan scheme online apply. This feature was recently introduced by the Akhuwat Foundation It is to be put on the official website where the user can know the status of his loan by entering his ID card number and mobile number/file number and can find out how many installments have been paid and how much is left to be paid akhuwat loan online apply.

SOME SIMPLE STEPS TO APPLY FOR AKHUWAT LOAN

- First of all, you have to go to the official website of the Akhuwat Foundation which is (https://akhuwatloanapplyonline.com).

Secondly, you have to find the loan check system there, you have to enter your ID card number and mobile number to know the status of your loan. - Secondly, you have to find the loan check system there, you have to enter your ID card number and mobile number to know the status of your loan.

- Now You have to press the check loan button, then your Akhuwat Foundation loan status will appear in front of you, It will have all the information about how many installments you have paid how much is left how much your total loan and How much time is remaining for your loan akhuwat foundation loan online apply.

- your name will also appear there, so you can easily know by using the Akhuwat Foundation loan check system. It is a very user-friendly and useful system introduced by Akhuwat Foundation.

If you don’t understand this method, then you don’t have to worry at all, you have to call the Akhuwat head office contact number immediately and our representative will guide you better.

Akhuwat Foundation Loan Scheme

Akhuwat Foundation has launched a scheme that is very beneficial to everyone. Every poor and rich needy can benefit from this scheme akhuwat loan apply. It is obtained by showing a small proof, it does not require any big proof, usually more than 50 lakhs is required income proof, in which you have to show any of your solid business proof online apply for akhuwat loan.

We have officially introduced this limit which everyone will be able to use easily because of these activities Akhuwat Foundation is very popular all over Pakistan so apply now from all over Pakistan whether you have a small business or a big business akhuwat foundation online apply.

The Akhuwat Advantage

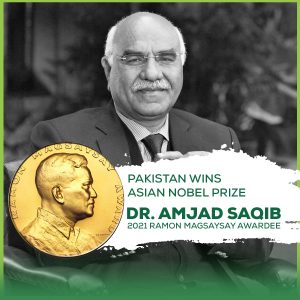

- A Legacy of Trust: akhuwat loan scheme With a rich history grounded in compassion, integrity, and community service, Akhuwat Loan Apply transcends being merely a financial institution online apply for akhuwat loan in urdu. We’re a trusted partner on your journey to success. For over a decade, we’ve been committed to empowering individuals and communities through our innovative financial solutions and unwavering dedication to social impact akhuwat loan apply form.

- Comprehensive Financial Solutions: From personal loans and business financing to microfinance and beyond, Akhuwat foundation loan offers a diverse range of financial products and services tailored to meet your unique needs and aspirations akhuwat loan apply 2025. Whether you’re a budding entrepreneur, a seasoned professional, or a community leader, we’re here to support you every step of the way.

- Customer-Centric Approach: Your satisfaction is our top priority. Our team of experienced professionals is dedicated to providing you with personalized service, transparent communication, and unparalleled support throughout your journey with us. Whether you have questions about our products and services or need assistance with your application, we’re here to help.

Empowering Dreams, Transforming Lives

At Akhuwat foundation loan, we believe that every individual deserves the opportunity to pursue their dreams and achieve their full potential. Whether you’re looking to start a new business, expand your existing operations, or pursue personal goals and aspirations, we’re here to help you turn your dreams into reality. With our flexible loan options, competitive interest rates, and unwavering commitment to your success, we’re more than just a financial institution. We’re your partner in progress.

Our Commitment to Excellence

Ethical Practices: Integrity, honesty, and transparency are the pillars of our organization. We adhere to the highest ethical standards in everything we do, ensuring that our customers receive fair, transparent, and ethical treatment at all times.

- Social Responsibility: Beyond profits, we measure our success by the positive impact we create in the communities we serve. Through our social initiatives, community development programs, and strategic partnerships, we’re committed to driving sustainable change and making a meaningful difference in the lives of those who need it most.

- Continuous Innovation: In today’s fast-paced world, innovation is key to staying ahead of the curve. That’s why we’re constantly exploring new ideas, technologies, and strategies to improve our products, services, and customer experience. By embracing innovation and embracing change, we’re able to adapt to the evolving needs of our customers and deliver greater value and impact.

Financial Literacy: The Key to Success

- Understanding Financial Basics: Financial literacy is the foundation of financial independence. In this section, we’ll cover essential financial concepts such as budgeting, saving, investing, and debt management. By mastering these fundamentals, you’ll be better equipped to make informed financial decisions and achieve your long-term goals.

- Building a Budget: A budget is a roadmap to financial success. Learn how to create a realistic budget that aligns with your income, expenses, and financial goals. We’ll provide practical tips and strategies for budgeting effectively, tracking your spending, and making adjustments as needed to stay on track.

- The Power of Saving: Saving money is the cornerstone of wealth-building. Explore the benefits of regular saving, whether it’s for emergencies, short-term goals, or retirement. We’ll delve into different saving strategies, such as automatic transfers, high-yield savings accounts, and retirement plans, to help you grow your savings faster and achieve your goals sooner.

Investing for the Future

- Introduction to Investing: Investing is essential for building wealth and achieving long-term financial security. Within this chapter, we’ll unravel the complexities of investing, covering essential principles like risk, return, diversification, and asset allocation. No matter if you’re new to investing or an experienced pro, you’ll find priceless insights and advice to navigate the markets with confidence.

- Building an Investment Portfolio: A well-diversified investment portfolio is crucial for managing risk and maximizing returns. Acquire Akhuwat knowledge on crafting a diversified portfolio aligned with your risk tolerance, investment aspirations, and time frame. We’ll delve into various asset classes like stocks, bonds, mutual funds, and real estate, and deliberate on techniques for maximizing your portfolio’s potential for sustained growth and stability.

- Investing for Retirement: Planning for retirement stands as one of the paramount financial objectives you’ll ever set. Explore the diverse array of retirement planning options available to you, including employer-sponsored plans like 401(k)s and IRAs, as well as individual retirement accounts and annuities. We’ll help you assess your retirement needs, set realistic savings goals, and create a personalized retirement plan that ensures a comfortable and secure future.

Navigating Financial Challenges

- Managing Debt: Debt can be a significant obstacle to financial freedom if not managed properly. In this section, we’ll discuss strategies for managing debt responsibly, including debt consolidation, refinancing, and repayment plans.

- Overcoming Financial Obstacles: Life is replete with unforeseen challenges and setbacks, yet armed with the appropriate mindset and strategies, you can surmount them.

- Protecting Your Assets: Protecting your assets is essential for safeguarding your financial future. From insurance coverage to estate planning, we’ll discuss various strategies for protecting your wealth and ensuring that your loved ones are taken care of in the event of unforeseen circumstances.

Building Wealth and Giving Back

- Creating Generational Wealth: Building wealth is about creating a lasting legacy for future generations. Learn how to build generational wealth through smart investing, strategic planning, and responsible financial management. We’ll discuss strategies for passing on wealth to your heirs tax-efficiently and ensuring a bright financial future for your family.

- Giving Back to the Community: As you achieve financial success, it’s important to give back to those in need and make a positive impact in your community. Discover the joy of philanthropy and volunteerism and find meaningful ways to give back through charitable donations, community service, and social entrepreneurship. Together, we can make a difference and create a more equitable and prosperous world for all.

The Future of Financial Education

- Embracing Technology: In an increasingly digital world, technology plays a vital role in shaping the future of financial education. Explore innovative tools and platforms that make learning about personal finance more accessible, engaging, and interactive. From mobile apps to online courses and virtual reality simulations, discover how technology is revolutionizing the way we teach and learn about money management.

- Expanding Access to Financial Education: Access to quality financial education is essential for promoting economic empowerment and social mobility. Learn about initiatives and programs aimed at expanding access to financial education for underserved communities, including low-income individuals, minorities, and women. Discover how organizations like Akhuwat foundation loan are working to bridge the financial literacy gap and empower individuals from all backgrounds to achieve their financial goals.

- Promoting Financial Inclusion: Financial inclusion is key to reducing poverty and inequality and fostering sustainable economic development. Discover approaches to advancing financial inclusion, including broadening access to cost-effective banking services, extending microfinance endeavors, and fostering digital financial literacy. Learn how Akhuwat foundation loan is leveraging technology and partnerships to extend financial services to marginalized communities and promote inclusive economic growth.

Your Financial Journey Begins Here

Congratulations! You’ve reached the end of this comprehensive guide to financial literacy and empowerment. Armed with the knowledge, skills, and resources provided in this guide, you’re now ready to embark on your journey to financial freedom and success. Remember, achieving financial independence is a lifelong process that requires dedication, discipline, and continuous learning.

At Akhuwat foundation loan, we’re here to support you every step of the way. From personal loans and credit cards to investment advice and retirement planning, we have everything you need to achieve your financial dreams.

Thank you for choosing Akhuwat foundation loan as your trusted financial partner. We look forward to helping you achieve your goals and build a brighter, more prosperous future. Together, let’s unlock the doors to financial freedom and create a world where everyone has the opportunity to thrive. Welcome to the Akhuwat Loan Apply family, where your financial journey begins!